B.C. budget highlights, from soaring deficit to family benefit boost and free IVF

VICTORIA — The 2024 British Columbia budget includes new spending measures designed to ease high costs of living, while significantly boosting the province’s deficit. Here are some highlights:

THE DEFICIT

The 2024/2025 deficit is projected to rise to $7.9 billion, up from $5.9 billion in the updated 2023/2024 forecast.

Advertisement

SPENDING

Taxpayer-funded three-year capital spending almost doubles compared to the past three years, increasing to $43.3 billion, with big outlays on school, health and transport infrastructure.

COST OF LIVING

Families with children get a one-year 25 per cent bonus to their BC Family Benefit. On average, families get $445 more over the year. The measure, which starts in July, will cost $248 million and benefit 340,000 families, with 66,000 to get the benefit for the first time.

A one-time electricity credit will save households an average of $100 over a year, with the credit appearing first on the April bill.

Advertisement

Small and growing businesses benefit from an increase in the health tax payroll threshold.

HOUSING

A flipping tax will be introduced next year, targeting speculators who the province says are driving up housing costs. Profits will be taxed if a home is resold within two years of purchase. Revenue will go to homebuilding.

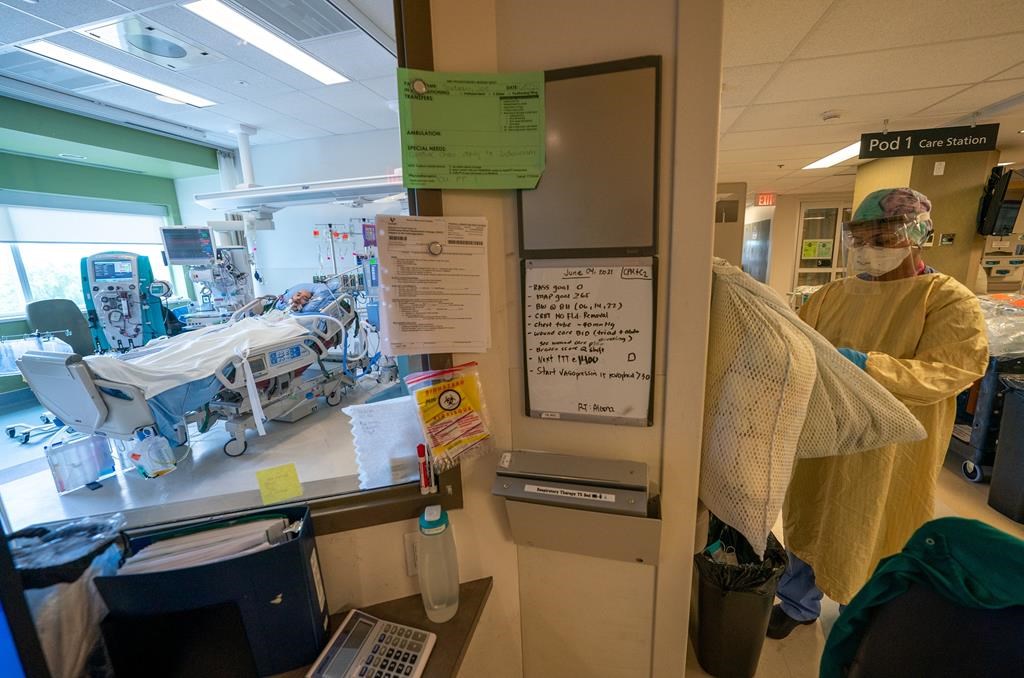

HEALTH AND SERVICES

From next year, a single cycle of free in-vitro fertilization treatment will be available to people, regardless of income, “who they love, or whether they have a partner,” says Finance Minister Katrine Conroy.

Advertisement

The budget earmarks $8 billion over three years to boost health, education, justice and public safety.

CLIMATE

Some $405 million will be spent over four years to better protect communities against climate emergencies.

This report by The Canadian Press was first published Feb. 22, 2024.

Advertisement

The Canadian Press