Freeland emphasizes Bank of Canada’s independence after Singh criticizes rate hikes

Posted Oct 25, 2022 07:35:59 PM.

OTTAWA — As another interest rate hike looms, Finance Minister Chrystia Freeland is emphasizing the Bank of Canada’s independence after criticism from federal NDP Leader Jagmeet Singh.

Singh sent a letter to Prime Minister Justin Trudeau Friday warning that another rate hike will have a “serious impact on families” as fears of a recession grow.

The central bank is expected to raise its key interest rate by half or three quarters of a percentage point on Wednesday in an effort to clamp down on decades-high inflation, making it the sixth consecutive rate hike this year.

When asked by reporters Tuesday what she thought of Singh’s letter, Freeland acknowledged the economic pain Canadians are feeling but noted that institutional stability is important during challenging economic times, with the Bank of Canada’s independence playing an important role in ensuring stability.

“Our government respects very much the independence of the Bank of Canada,” Freeland said.

However, she also acknowledged that Canadians have been facing tough economic conditions amid high inflation and rising interest rates.

“Inflation is too high. Life is really tough for a lot of people and rising interest rates are posing another set of challenges,” Freeland said.

In his letter, Singh reaffirmed support for the Bank of Canada’s independence and acknowledged the bank is following its mandate by raising interest rates, but warned the aggressive rate hikes would hurt workers.

“This one-size-fits all solution to inflation is already laying the groundwork for a recession and making life hard for most people, especially working families and Canadians living on fixed incomes – like seniors and people living with disabilities,” Singh wrote.

A growing number of economists are forecasting Canada will enter a recession in 2023 as the effect of higher interest rates works its way through the economy. Since March, the Bank of Canada has raised its key interest rate from 0.25 to 3.25 per cent, making it one of the fastest monetary policy tightening cycles in its history.

As fears bubble about an impending economic slowdown, labour have come out against the aggressive rate-hiking path over concerns about the potential impact of a recession on employment.

A new report by the Centre for Future Work in collaboration with the Canadian Labour Congress called on the Bank of Canada to pause its rate hikes until it can assess the impact of previous interest rate increases on the economy.

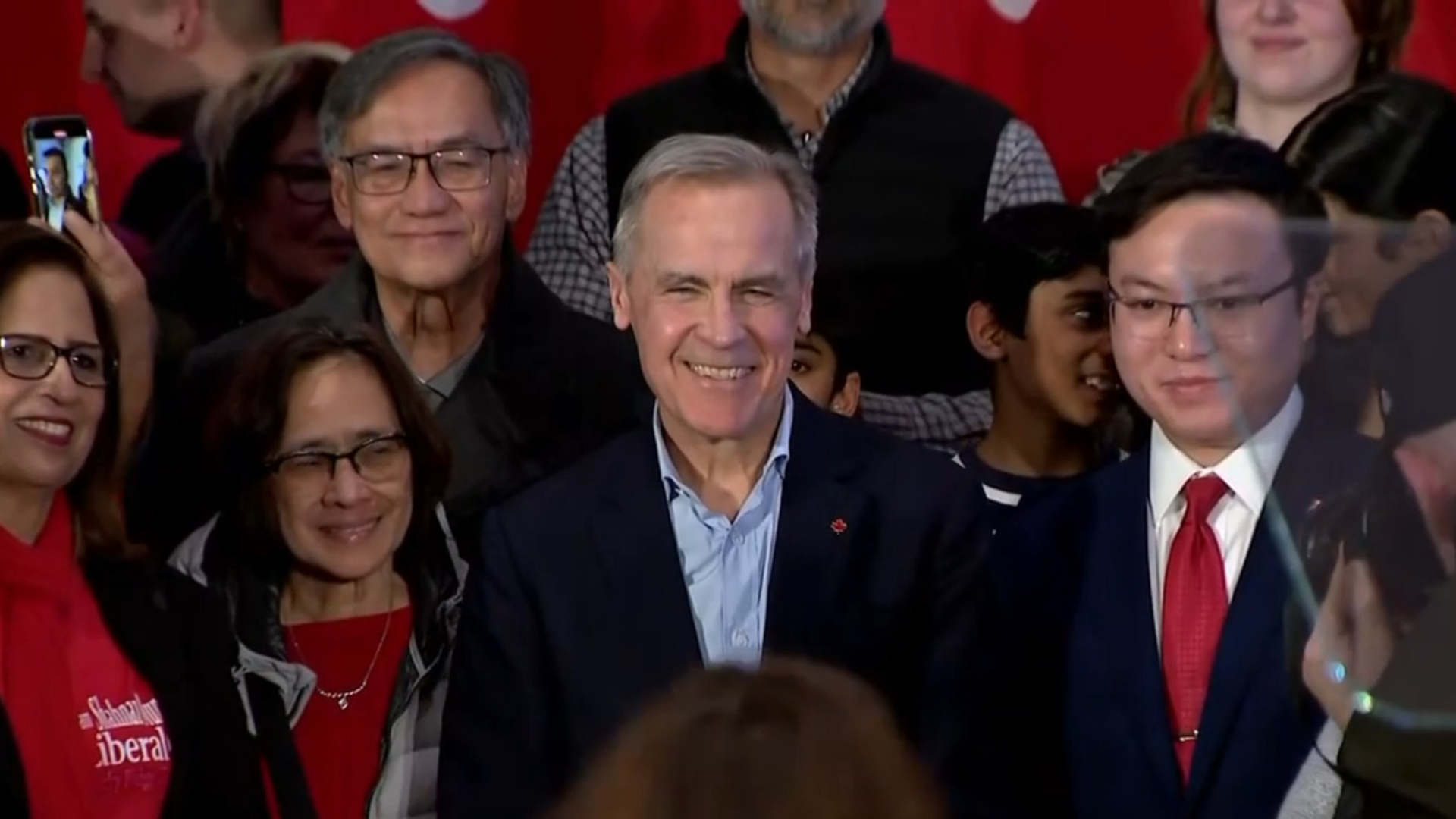

However, Macklem said in recent weeks the bank’s primary focus is restoring price stability, as is outlined by its mandate.

The central bank’s agreement with the federal government on its monetary policy framework is renewed every five years. It was revised last December for the 2022 to 2026 period, and added that monetary policy should support maximum sustainable employment — though it stopped short of making it an explicit target.

The primary mandate for the bank is still maintaining low and stable inflation.

Singh criticized the federal government in his letter for missing an opportunity in the Bank of Canada’s mandate to give it a more active role in protecting employment.

“Last fall, your government had the opportunity to revise the Bank of Canada’s mandate, but instead of changing the mandate, you kept the traditional narrow focus on inflation targeting with an added consideration for maximum sustainable employment,” he said.

As a potential recession looms, Singh called on the federal government to do more to protect Canadians, including addressing “corporate greed” and introducing long-promised reforms to the employment insurance program.

This report by The Canadian Press was first published Oct. 25, 2022.

Nojoud Al Mallees, The Canadian Press